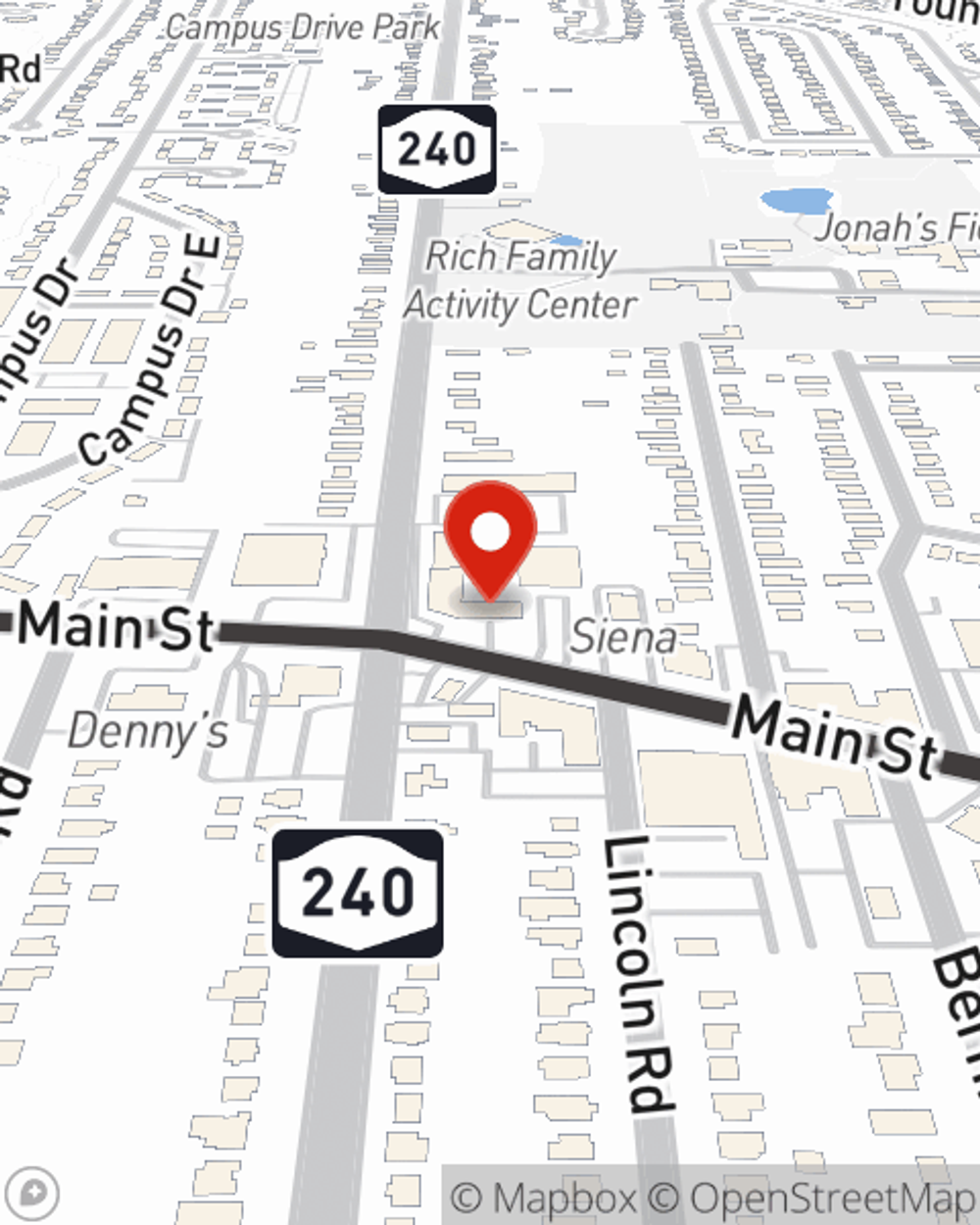

Business Insurance in and around Amherst

One of Amherst’s top choices for small business insurance.

Almost 100 years of helping small businesses

- Amherst

- Williamsville

- Snyder

- Buffalo

- Tonawanda

- Clarence

- Cheektowaga

- North Tonawanda

- Niagara Falls

- Lockport

- Depew

- Kenmore

Cost Effective Insurance For Your Business.

Operating your small business takes time, creativity, and excellent insurance. That's why State Farm offers coverage options like business continuity plans, a surety or fidelity bond, errors and omissions liability, and more!

One of Amherst’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a bakery, a floral shop, or an arts and crafts store, having the right coverage for you is important. As a business owner, as well, State Farm agent Scott Krevat understands and is happy to offer customizable insurance options to fit your needs.

Get right down to business by reaching out to agent Scott Krevat's team to discuss your options.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Scott Krevat

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.